Navigating Fintech: Staffing for the Future of the Financial Industry

Key Takeaways:

- Using proven staffing strategies like talent development programs, partnerships with higher education, and flexible staffing models can help bridge talent gaps and make hiring easier.

- Focusing on retention strategies like competitive compensation, showcasing innovation and a positive work culture could lead to fewer staffing challenges.

- An awareness of emerging trends (AI, automation, blockchain) in fintech could help staff more effectively and mitigate staffing challenges as well.

The current fintech landscape includes banking automation, the emergence of AI, and increasing regulatory burdens, along with the need for airtight security. In order to fulfill these urgent needs, staffing has become an essential priority.

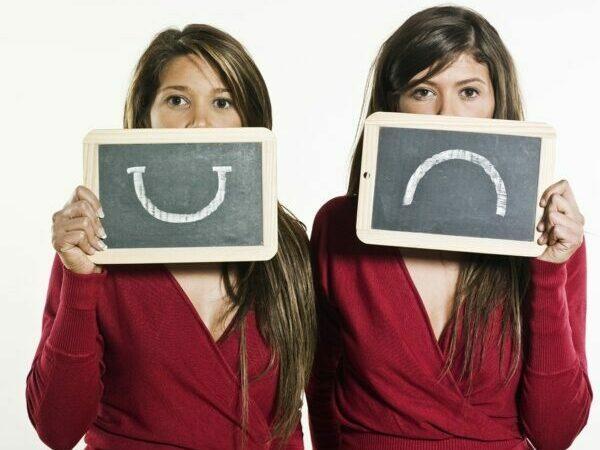

Despite fintech’s desperate need for top talent, most tech workers have not been attracted to careers in the industry because of negative perceptions about fintech that are largely untrue. To navigate these challenges effectively, strategic staffing is of the utmost importance.

Challenges in Fintech Talent Acquisition

One of the major challenges in fintech IT staffing is the competition for IT talent from other industries that seem to be more attractive. Most IT workers don’t get as excited about working for an insurance company or a bank since they don’t consider it as ‘glamorous’ as employment at a software startup or a big tech company.

Another challenge in IT recruiting for fintech is that niche skills are sometimes required that some IT workers might not have. Many fintech jobs require an understanding of financial services, and they also require significant expertise in SQL, Python and R programming languages, advanced Excel functions, and even in data analysis/visualization.

Targeted recruiting campaigns that showcase the benefits of IT jobs in fintech is one of the solid recruiting strategies that can be used to overcome these challenges. Employer branding can also attract more highly skilled IT workers to the fintech industry.

Strategic Staffing Solutions for Fintech

To find the fintech workers companies need, the following staffing solutions may be effective:

Flexible staffing models–Many companies are moving toward more closely matching their workforce with the amount of work they have at any given time. These methods may include a mix of full-time, part time and temporary workers that can be scaled up or down as needed. Remote and hybrid working arrangement are another part of a flexible staffing model for some fintech companies.

Partnerships with educational institutions–Higher education institutions like colleges, universities, and technical schools can be a source of fresh talent for companies willing to partner with them. This could mean providing internships, mentoring, or even classroom instruction in order to identify the best students and recruit them, sometimes before they even graduate.

Internal talent development programs–Companies will often have talented workers who could fill talent gaps if they receive more training in needed skills. When companies provide these development programs, they not only solve their own talent problems, they create more loyal and engaged workers and retention often improves.

If these strategies don’t yield the talent companies need, staffing agencies are an effective way for fintech companies to find talent. With a deep understanding of the industry and a long list of potential candidates, a staffing agency can often quickly solve what was previously a frustrating issue for hiring managers.

Attracting and Retaining Top Fintech Talent

The basics of attracting top fintech talent include offering competitive compensation and benefits. While there can be exceptions, many firms find it nearly impossible to attract quality talent without matching the competition in these areas. An even better strategy is to offer unique benefits that other companies don’t. This can help you stand out from the crowd and give you a competitive advantage.

A positive work culture attracts top workers because they know they don’t have to put up with negativity and poor working conditions. No one wants to work in a toxic environment, and top talent simply won’t because they can afford to be picky.

Showcasing innovation is another good strategy for snagging fintech talent because most IT workers want to be on the cutting edge of the industry. When a company is innovative and can show it during the recruiting process, it becomes much more attractive to IT workers and they are more likely to give the industry a shot.

When it comes to retaining fintech talent, it’s important to show career development opportunities and ways workers can advance within the company. Other effective retention strategies include work-life balance initiatives and programs to foster employee engagement. When workers have a sense of purpose, they are more likely to be engaged and stay, rather than leaving for another job.

Emerging Trends in Finance and the Impact on Staffing

Keeping an eye on emerging trends can be a way to start attracting talent in these areas before they are too well known and competition for talent becomes intense.

Some of the key emerging trends in fintech today include blockchain, digital payments, and AI and automation of financial services. These trends are reshaping fintech and the way people manage and access money as well as invest and perform other financial transactions.

In terms of fintech staffing, emerging trends have led to demand for specific IT skills and roles. Here are some in-demand jobs in fintech that have developed from these trends and some of the skills they require:

Blockchain developer–multiple programming languages,cryptography, analytical and problem-solving skills.

AI data scientist–database and network skills, SQL, Python, Oracle, and various data tools specific to the system being used.

AI software developer–front end programming, web development, Open AI and specific AI frameworks, agile development skills.

Digital assets specialist–Could require DeFi, NFTs, DAOs, Blockchain, Web 3.0, Cloud architecture, Payment rails, experience with sales and development goals.

Conclusion

With the strategies outlined above and a thorough understanding of the challenges of hiring in the fintech sector, it is possible for companies to find the top IT talent they need to drive innovation and success.

If your company needs more help and expertise in fintech hiring, GDH offers ready-to-go talent pipelines and best practices recruiting methods. If you’ve been searching for the premier staffing agency look no further. We’re it.